The Federal Reserve kept the market’s agreement on December 16, announcing in its meeting policy statement as expected that it would double the pace of code cuts to $30 billion per month, with the dot plot showing that three rate hikes each are expected in 2022 and 2023, more hawkish than the market expects, and that the rate hikes will be faster than economists expect, with Chairman Powell saying that interest rates may be raised before full employment is achieved, which also means that the Fed is casting all The bet, which is one of the most drastic hawkish turns in its monetary policy in more than a decade, highlights the determination to curb the worst inflation in decades. U.S. bond yields climbed after the meeting’s policy statement was released, and were sold off by the market.

A U.S. financial regulatory agency

The Fed’s latest meeting statement has deleted the expression “inflation is temporary”, which confirms the Fed’s previous major misjudgment of the inflation situation, “on inflation, it is time to give up the word “temporary””, which means that the Fed has been “hit in the face” on the issue of inflation, officially conceding defeat, and means that the Fed is under the pressure of high inflation, in the monetary interest rate normalization policy soft, and faster than most investors envisage.

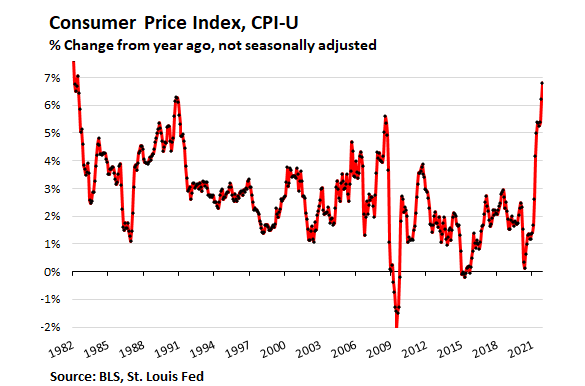

The U.S. Department of Labor released a strong rise in the Consumer Price Index (CPI) in November on December 10, recording the largest year-over-year increase since June 1982, as food and a range of commodity prices soared, which has created a nightmare for Americans and reinforced expectations that the Fed will begin raising interest rates in 2022, with specific data showing that the CPI, following a 0.9% rise in October, rose in November from a year earlier rose 0.8% and surged to 6.8% year-over-year.

At the same time, the U.S. University of Michigan consumer confidence index in December also rebounded from a ten-year low, which also means that the inflation rate is expected to remain high, market analysis, the Fed is expected to announce an accelerated reduction in the policy meeting to be held on December 15, JP Morgan Chase will be the Fed’s first rate hike is expected to advance the time to June next year, immediately after the Allianz chief economic adviser El-Erian said that the Fed’s previously thrown inflation temporary theory may be the worst inflation expectations in the history of the Fed, and bring turmoil to the U.S. bond market trading.

On December 16, U.S. Treasury yields rose sharply, with the U.S. 10-year U.S. bond yield oscillating 4.43 basis points in the short term to touch a high of 1.4684%, with a current intraday gain of about 2.7 basis points. The 2-year U.S. bond yield spiked nearly 5.0 basis points in the short term after the release of the Fed’s resolution statement, setting a new daily high of 0.7155%, while the U.S. Treasury stalled a week ago when it issued $60 billion in 30-year and 5-year Treasury bonds with winning yields above the pre-issuance yields and at the lowest winning levels since January.

According to data monitored by Bloomberg on Dec. 12, U.S. bonds are now trading in the worst condition since March last year, with the U.S. bond market littered with landmines and extremely volatile, making investors lose a lot of money, with outflows rising to $29.8 billion in the seven weeks ended Dec. 11. Immediately after, the New York Fed postponed the planned purchase of 5-year to 30-year inflation-protected bonds to December 15 on the grounds of technical difficulties, followed by very weak and weaker-than-expected demand for tenders for 2-year and 5-year Treasuries issued by the U.S. Treasury.

And according to a report by Jim Reid, senior analyst at Deutsche Bank, 85% of U.S. bond products of all maturities in the U.S. bond market, including high-yield junk bonds, now have negative real yields, which are below the current inflation rate (please refer to the chart below for specific data trends).

In addition, according to the latest international capital flows report released by the U.S. Treasury on December 16 (the official data on U.S. debt is subject to a two-month delay convention), foreign investors, including global central banks, sold $43.5 billion of U.S. debt in October, the largest outflow of funds since May this year, in which global central banks reduced their net holdings of U.S. debt for the sixth consecutive month.

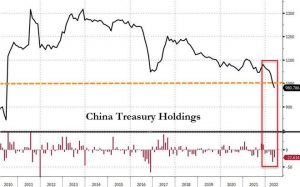

It is worth noting that the U.S. Treasury report shows that China began to significantly increase its holdings of U.S. debt by $17.8 billion in October, following a small increase of $600 million in September, increasing the size of its holdings of U.S. Treasuries to $1.065 trillion, ending a significant reduction of $21.3 billion in August this year, when the size of China’s position in U.S. debt hit its lowest since 2010, but China’s current holdings of U.S. debt are still at low values, close to the July 2021 level.

According to data from the U.S. Treasury Department, overall, China’s net holdings of U.S. debt decreased by $6.9 billion in the first 10 months of 2021. According to the BWC Chinese Bajia financial research team, China had a net reduction of U.S. debt for five months from March to September this year, amounting to $53 billion (please refer to the chart below for specific data trends), of which, in addition to a significant reduction in August, the other two significant reductions in U.S. debt were in May and June, with a reduction of $17.7 billion and $16.5 billion, respectively.

Meanwhile, Japan also substantially purchased $20.8 billion of U.S. debt in October, increasing the size volume to a record high of $1.32 trillion, in addition, the UK and Ireland also increased their holdings of U.S. debt by about $14 billion, respectively. However, since March 2020, the supply of U.S. bonds has been surging, and the continued months of high inflation and the oscillating downward trend of the U.S. dollar index have depreciated the value of U.S. dollar debt assets and attractiveness significantly.

And the most worrying market is that the largest purchaser of U.S. bonds, the Federal Reserve also began to reduce the purchase of U.S. bonds from November, and just announced a doubling of the reduction of U.S. bonds, with the arrival of the Fed’s quantitative easing tightening phase, if the Fed gradually withdraws from the final buy order after March 2022, then the initial choice of arbitrage global central banks may face a shift in demand for U.S. bonds. In fact, since last March, the U.S. federal debt deficit has ballooned sharply and zero interest rate policy has been implemented, and the real yield of the 10-year U.S. bond, the anchor of global asset prices, is in negative territory (please refer to the chart below for specific data), leading to a decline in attractiveness (please refer to the chart below for specific data trends).

It is against these backdrops that some smart international money has begun to move out of the U.S. asset market in order to replace non-dollar assets such as gold, suggesting that gold is returning from the periphery of the monetary historical horizon to hedge against U.S. debt exposure risk. Data provided to us by the IMF and the World Gold Council show that we have noted a continuing trend of displacement from bonds to gold in recent months.

According to the latest report released by the World Gold Council on December 10, global gold ETFs saw a net inflow of 13.6 tons (about $838 million, an increase of 0.4% in AUM) in November, with total global gold ETF positions rebounding to 3,578 tons (about $208 billion) and global official gold reserves totaling 35,582.3 tons, according to the data, 2021 In the first three quarters of 2021, global central banks bought a net 393 tons of gold. Notably, according to the association’s newly released Global Gold Demand Report, China’s gold consumption and investment demand also saw an overall explosive growth in the third quarter of 2021, with gold imports picking up significantly (please refer to the chart below for specific data trends).

The report shows that China’s gold imports totaled 228 tons in the third quarter of 2021, a 300% jump year-over-year, which also brought China’s total imports from March to September 2021 to 513 tons, demand for gold jewelry reached 157 tons, up 32% year-over-year, and sales of gold bars and coins totaled 65 tons, up 12% year-over-year.

According to data released by the State Administration of Foreign Exchange on Dec. 9, the People’s Bank of China’s gold reserves remained unchanged at 1,948.3 tons at the end of November, unchanged from the end of October. According to an industry report cited by U.S. financial website Zerohedge on Dec. 13, gold exports from Europe and the United States to China also rose significantly, the highest since 2019, with the latest shipment of about 195 tons of gold having arrived in China from European and American markets between October and November.

Also according to Shanghai Gold Exchange (SGE) data, gold outflows from the Shanghai Gold Exchange rose sharply to 191 tons in September, up 27% from the previous month and 63% from September 2019, and gold (futures) trading volumes on the SGE and SSE also reached 4,163 tons in August, up 6.5% from the previous month, while total gold trading activity from December 2016 to date has reached a record 25,300 tons, and these above statistics suggest that at least 708 tons of gold have been arriving in the Chinese market since the beginning of 2021.

In this regard, Jim Rickards, a Wall Street veteran and well-known economist and author of the U.S. book Currency Wars, agrees that it is not surprising that gold has been flowing to the East in recent years, with a Western gold shift to the East, just as gold had been flowing to the U.S. market before Bretton Woods.