The Bank of England just raised interest rates, 25 basis points, and the interest rate on the pound is 1.25%. The British interest rate hike is not as strong as the U.S. dollar, the Federal Reserve raised interest rates yesterday by 75 basis points, is 25 + 50 + 75 = 150 basis points, 1.5% – 1.75%.

As you can see, the title of the American Empire is true to its name, and the title of Little Britain is also true to its name. The yen is still a negative interest rate, the euro is still a negative interest rate. The British pound rate hike of 25 basis points, not as strong as the dollar! The dollar, the imminent return of the king?

The rate hike is a physical job, the body is not strong can not do.

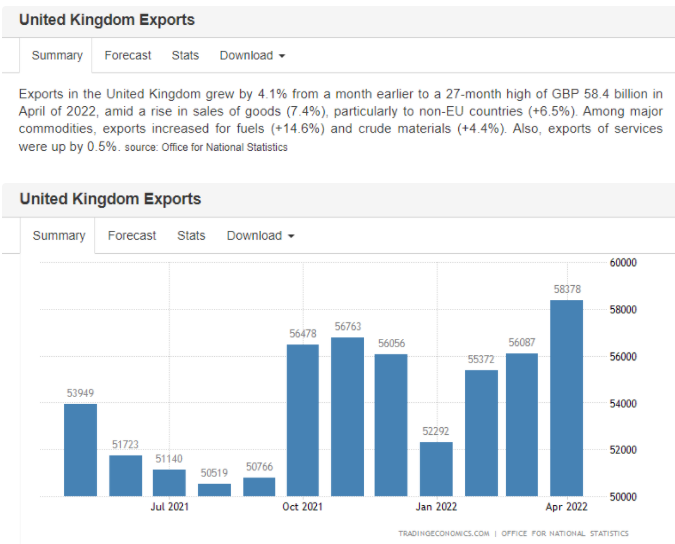

British inflation is as high as 9%, higher than the U.S. inflation of 8.6%, while the rate hike is much more abject. It is clear that the British economy is really not working. British exports in April 58.4 billion pounds, now 1 pound is 1.2 dollars, that is 70 billion dollars.

South Korea exported $57.69 billion in April and $61.52 billion in May. That is, the real strength of the United Kingdom, in fact, on the level of South Korea. Although Britain has nuclear weapons, but Britain and South Korea are both American little brother, with the United States nuclear weapons cover, about the same as Britain and South Korea on the level of nuclear weapons equivalent. Moreover, North Korea has nuclear weapons.

Britain and South Korea, both bought the U.S. F-35 stealth fighter. South Korea has already received dozens of F-35s. The population of the UK is 66.8 million and South Korea is 51 million. In terms of exports per capita, South Korea is better than the UK. If Korea is reunified, the combined power of the Korean Peninsula will exceed that of Little Britain. South Korea also raised interest rates by 25 basis points, but South Korea is 1.75% interest, synchronized with the dollar.

The ability to raise interest rates reflects the economic strength of a country.

After the Federal Reserve raised interest rates again in July by 75 basis points, the dollar will pull away from the pound, the yen, the euro and other currencies for a period of time. The key to this is that the dollar is a foreign reserve, there are many countries hoarding U.S. debt, to give the dollar backing. Once the Federal Reserve really raised the dollar to 3% above, it will be the return of the king of the dollar, the pound euro yen against the dollar will plummet.

After Latinos vote for the Republican Party, the next American police will be strict enforcement of crime, and then the security of the United States will become better.

Next, the U.S. $30.4 trillion national debt, may force Biden to start cutting jobs. It is possible that the U.S. federal government will shut down in 2023 and then start laying off civil servants and eliminating spending. At 3.5% interest, a $30.4 trillion national debt would be over $1 trillion a year in interest payments.