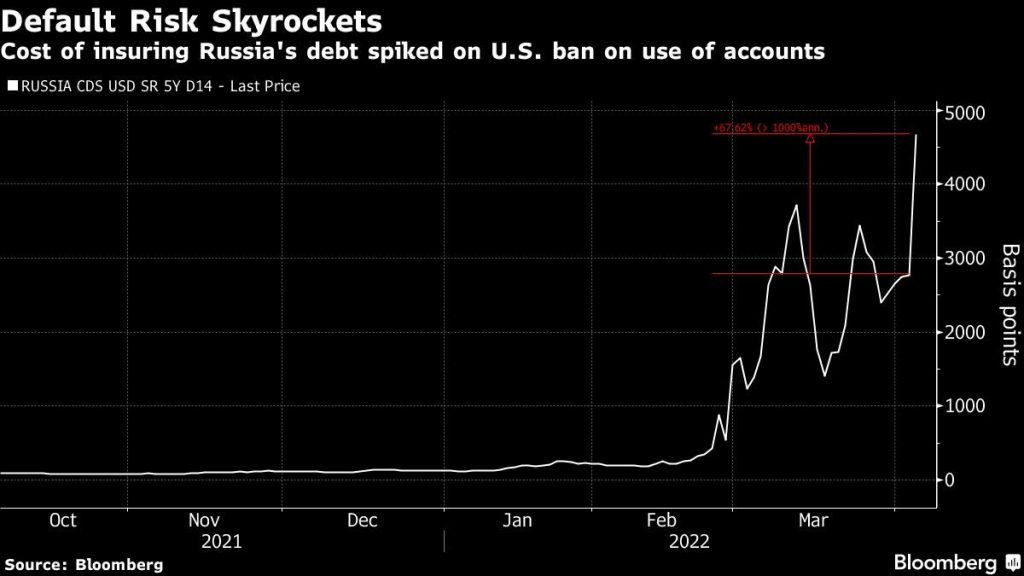

The cost of insuring Russia’s debt against default has risen sharply on Tuesday (April 5), which ultimately means the likelihood of Russia defaulting on its debt within five years is 87.7 percent, according to data from CMA, a division of consulting and research firm ICE Data Services, Bloomberg reported this month on April 6.

On April 4, the U.S. government banned the Russian government from paying more than $600 million in debt through accounts it opened at U.S. banks, a move intended to increase pressure on Russia and deplete its dollar holdings. As a result of the news, the probability of a Russian default has risen to 77.7% on Monday (4), well above the 24.1% level seen on Feb. 24 when tensions between Russia and Ukraine escalated.

If Russia defaults on its debt, its financial credibility will be damaged and the threshold and cost of future borrowing will be raised.

Reuters reports that if Russia fails to make any upcoming bond payments within a scheduled time frame, or uses rubles in the case of payments designated in dollars, euros or other currencies, then it will be in default. A default would mean that Russia would not be able to regain access to the loan until creditors are paid in full and any legal action arising from the default is resolved.

Reuters reports that Russia is now excluded from international lending markets because of Western sanctions. Meanwhile, its foreign exchange reserves worth hundreds of billions of dollars have been frozen. By the beginning of this month, Russia had 15 outstanding international bonds with a face value of about $40 billion. The recent series of U.S. pressures on Russia are aimed precisely at dismantling the Russian government’s efforts to avoid defaulting on its debt.

Reports suggest that a debt default would spell trouble for Russia if countries or corporate entities that trade with Russia have internal rules that prohibit transactions with defaulting entities; moreover, if Western sanctions were someday lifted, a history of debt defaults would still continue to damage Russia’s reputation in financial markets, depressing its credit rating and raising interest rates on borrowing by the Russian government or businesses.

As previously reported by the Observer, on April 4 a U.S. Treasury Department spokesperson said the U.S. government blocked a debt payment worth $552.4 million (roughly $3.517 billion) that included a debt due from Russia that day, while announcing the U.S. government’s decision to cut off Russia’s access to frozen funds. Also due at the same time that day was a 2042 sovereign dollar bond with a coupon of $84 million (about 535 million yuan). The spokesman said the move was intended to force Russia to make the difficult choice of whether to use the dollars available to the country to pay off its debt or for other purposes, including so-called “support for war.