Russia’s finance ministry previously promised to pay off Eurobond, a $2 billion debt that matures on April 4. But the Russian Finance Ministry offered on Tuesday (March 29) to buy back the dollar bonds maturing next week in rubles.

The so-called Eurobond, not specifically referring to the Eurozone bonds, refers to a government, financial institutions and industrial and commercial enterprises in the international market in a freely convertible third-country currency denominated and debt-servicing bonds, the coupon amount currency is not the local currency of the issuing country.

Bondholders should submit their requests to sell their holdings to the Russian State Settlement Depository between 13:00 GMT on March 29 and 14:00 GMT on March 30, the Russian Finance Ministry said on Tuesday.

The Russian Finance Ministry said the bonds, which were issued in 2012, will be repurchased at 100 percent of their nominal value. It is unclear whether there is a limit to the amount the government can buy back or what happens if creditors holding the bonds do not tender rubles to pay.

Analysts believe the move could help local bondholders accept ruble payments directly while bypassing the U.S. dollar and reducing the burden of debt service.

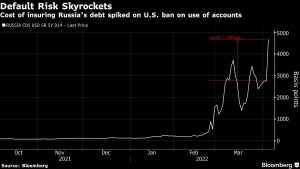

But Eurobonds are a class of bonds aimed at global markets, and if the terms stipulate that repayments must be made in U.S. dollars, repayments due in rubles could again raise the possibility of Russia’s first external sovereign default in a century.

Helping local investors

Analysts and investors say the move could be designed to help Russian holders who are now constrained in receiving payments in U.S. dollars. A number of large Russian banks have now been excluded from the SWIFT system.

Porwal, an analyst at Seaport Global, believes it is only an offer now and not a final decision, and perhaps the Russian government just wants to gauge the willingness of people to accept ruble payments.

Ash of BlueBay Asset Management says this is part of a counterattack by Russia’s central bank and finance ministry to fend off defaults and stabilize the market and the ruble.

Neuberger Berman Investment Experience Nazli said, “Everyone inside and outside of Russia wants dollars right now, so I think only local holders and banks affected by the sanctions will take advantage of this offer.”

Default fears soar

But Russia’s ruble offer is also a sideways reflection of the country’s current hard currency demand pressures and heightens market fears of a Russian sovereign default.

Nazli analyzed that foreign investors may be less interested in accepting ruble payments given that the ruble is “no longer a convertible currency.

JPMorgan Chase also said the bond does not have a payment clause in an alternative currency, but has a 30-day grace period.

Major asset managers such as Morgan Stanley, BlackRock and AXA all hold bonds that mature on April 4, according to analyst firm Refinitiv.

Earlier, Russia also proposed that European imports of Russian energy be paid in rubles in an attempt to bypass financial sanctions and ease pressure on the dollar.

So far, all of Russia’s maturing sovereign debt has been paid off. Earlier Tuesday, Russia’s finance ministry stated that it had paid a total of $102 million in coupons on Eurobonds due in 2035, the third bond payment Russia has made after default fears grew.

Russian officials said any payment problems that lead to a formal declaration of default would be artificial.

Russia’s next debt payment is due March 31, when a total of $447 million will be paid, and on April 4, it will also have to make interest payments totaling $84 million on dollar-denominated bonds due in 2042.