On the same day, Russian President Vladimir Putin said he had signed a decree on the settlement of gas trade in rubles, with new rules taking effect from April 1 that require gas buyers to open accounts in Russian banks.

The decree sets out the rules for Russia’s gas transactions with so-called “unfriendly countries”. That is, from April 1, companies from “unfriendly countries” should first open ruble accounts in Russian banks, and then buy Russian gas through this account settlement.

Putin also said that existing contracts that do not comply with the rules will be suspended, and gas contracts where buyers do not pay in rubles will also be suspended by Russia. “The buyer will be responsible for all consequences. No one is selling us anything for free, and we are not going to be charitable.”

In fact, back on March 23, Putin made the decision that gas supplies to European countries would be settled in rubles and asked the Russian Central Bank and government to develop norms related to ruble settlements with European countries within a week.

From the point of view of the current timing, the Russian Central Bank has completed the task given by Putin “on time”.

Earlier, Russian State Duma Chairman Volodin said that the refusal to use the dollar and the euro to settle gas transactions was a historic decision, without which Russia’s financial and economic sovereignty would be impossible to speak.

The first signs of the decree’s impact on the market are already visible.

Russian finance is “recovering lost ground” as the ruble soars

Previously, on the day Russian leader Vladimir Putin announced that “unfriendly” regions would have to buy Russian gas in rubles, the ruble briefly rose more than 8 percent against the dollar indicatively, and intraday prices on the Moscow Interbank Foreign Exchange MICEX rose 5.6 percent, the biggest gain since 2014.

While the ruble on Monday, March 28 has risen through the 90 ruble mark, a new high since March 1. March 31 close, the euro against the ruble 1: 92.5, the dollar against the ruble 1: 83.2, is constantly “recovering lost ground”, approaching the level before the war between Russia and Ukraine, than the March 7 record low of 151 rubles up more than 80%.

In addition, Russian stocks rose sharply on Thursday, with both indices up more than 7%. The Moex index rose 7.58% and the RTS index rose 7.59%, in addition, Gazprom rose 12.26% and Lukoil gained 10.51%.

It is worth mentioning that Russian State Duma Chairman Vyacheslav Volodin had warned on March 30 that not only gas but also exports such as oil, grain, fertilizers and timber may soon be priced in rubles.

In response, Kremlin spokesman Peskov said that settling commodity transactions in rubles “is in our interests and in the interests of our partners” and that “this could indeed work.”

Xu Boling, director of the Russian Economy Department at the Institute of Russian East European and Central Asian Studies of the Chinese Academy of Social Sciences, told Phoenix Eye of the Storm that it is perfectly feasible for Russia to settle commodity transactions in local currency in the future.

He believes that the diversification of the international reserve system is now a foregone conclusion, and using the local currency as an anchor will become a major trend in the currency market in the future. For Russia, a direct “peg” between the ruble and natural gas will also greatly reduce the pressure on Russia’s foreign exchange reserves.

Gold pegged to the ruble, Russia has long been laid out

In fact, the ruble is currently pegged not only to natural gas, but also to gold. Previously, on March 25, the Central Bank of Russia announced that from March 28, it would buy gold from credit institutions at a fixed price, with a purchase price of 5,000 rubles per gram during the period from March 28 to June 30.

Once this news came out, spot gold rose briefly by about $6 on the same day, touching a high of $1,961, making the day once overall turned up.

Russia is the major gold reserve country, with the fifth largest gold reserves in the world, holding 73.9 million ounces of gold reserves worth about $132 billion before the start of the war.

Interestingly, when Putin announced the settlement of the country’s natural gas in rubles, the chairman of the Russian State Duma’s energy committee, Zavarnae, added that “hard currency payments are also acceptable”.

The exchange ratio of 5,000 rubles for 1 gram of gold, combined with the March 30 New York Mercantile Exchange gold futures market price of $1,939 per ounce, that is, about $68.39/g of gold prices, a dollar can be exchanged for roughly 73.11 rubles, basically back to the pre-war level of the ruble exchange rate.

The purchase of natural gas with gold can be called “fair trade, no cheating”.

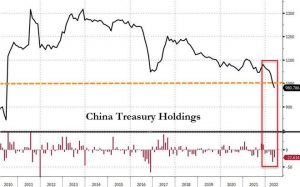

Russia’s gold reserves since 2000

Politically sanctioned, but capital is “going alone”, Wall Street is long Russian assets

It is worth mentioning that while Western governments are raising the sanctions stick, Wall Street has started to plunge and sing about Russian assets.

Since March, institutions such as Goldman Sachs and JPMorgan Chase have been buying cheap Russian corporate bonds, while hedge funds that specialize in buying cheap credit are also looking to increase their holdings of these assets, according to Bloomberg, citing people familiar with the matter.

At the same time, a team of strategists at the small firm upgraded the bonds of three Russian energy and steel companies to a “hold” rating in a research report in early March, especially Lukoil, which the firm even called the “best recovery investment” in Russia.

Goldman Sachs is focusing on buying corporate bonds of mining company Evraz Plc, Gazprom and Russian Railways due in the next 2 years, and has started bidding for Russian sovereign bonds.

Wall Street’s predictions were indeed accurate, as Lukoil rose 10.51% and Gazprom rose 12.26% by the close of trading on March 31.

Energy surge, “civil unrest” in Europe and the US

At present, there are already clear differences within Europe on the issue of sanctions against Russia.

In February, European energy prices rose by 31.7% and inflation was 5.8%.

On March 31, the price of natural gas in Europe continued to rise, exceeding $1,450 per 1,000 cubic meters. The TTF May futures price, considered the bellwether of European natural gas prices, reached $1,453 per 1,000 cubic meters.

The UnitedStates Natural Gas ETF, the UNG Fund, which tracks the price of near-month natural gas futures on the New York Mercantile Exchange (NYMEX), has accumulated a 55% gain year-to-date.

German officials issued an “early warning” on March 30 that the country could face a supply emergency. 55% of Germany’s gas supply in 2021 will come from Russia. German Deputy Chancellor and Minister of Economy and Climate Protection Habeck announced that Germany had launched a Level 1 natural gas emergency and urged people to save energy.

The Austrian climate ministry announced on March 30 that Austria has activated early warning in its gas supply contingency plan.

In the face of this combined ruble and natural gas “offensive,” there have been numerous disagreements and contradictions within the U.S. and Europe, with varying degrees of relaxation in the attitude of each country toward sanctions.

British Prime Minister Johnson, when asked whether Britain would buy Russian gas in rubles, did not explicitly deny it, but said, “That’s not what we want to do.

Germany, for its part, responded to Russia’s request for a gas settlement on March 31. German Chancellor Schulz again reiterated his country’s rejection of the ruble settlement. Germany said that the gas settlement will be carried out entirely in euros, but will transfer the settlement in euros to the sanctions-free Gazprom Bank, which will exchange the euros for rubles.

In addition, the German government said Chancellor Schulz has not yet agreed to the program offered by Russia and is requesting written materials to accurately understand the payment process.

On the same day, Italian Prime Minister Mario Draghi said he had spoken with President Vladimir Putin, who said that “payment in rubles is not acceptable and not feasible. But it is possible to try to pay in rubles, it will take time.”

Will the sanctions against Russia be “lifted in disguise”?

Earlier, the Russian TV website quoted a report by the German weekly Der Spiegel, which quoted German economists as saying that Europe would have to buy rubles from the Russian Central Bank, which was placed on the EU sanctions list earlier this month, in order to pay for gas-related expenses. The Russian decision indirectly forces Europe to bypass its own sanctions, and given the importance of Russian gas to EU member states, the Russian “Ruble Settlement Order” for gas would put enormous pressure on the West and would actually make Western sanctions ridiculous.

Xu Boling, director of the Russian Economy Department at the Institute of Central Asian Studies of Russian Eastern Europe, Chinese Academy of Social Sciences, told Phoenix Eye of the Storm that the European government’s stance is actually Russia and Europe “taking what they want” and giving each other a step down.

The natural gas, which is used for heating, cooking and providing energy for business and industry, is directly related to the increased costs of industry and households, rising inflation and economic recession, and Europe has to compromise on this.

Since there is almost no offshore market stock of rubles, and Europe does not hold a large amount of ruble reserves, so it can only be in accordance with the official Russian exchange rate to take the euro to the Russian central bank to exchange.

The move will not only increase ruble liquidity, but the anchoring with gas prices will ensure the strength of the ruble, which means that the sanctions imposed on Russia for more than a decade will be substantially lifted – Russia can sell its own gas around the sanctions to ease the economic pressure at home, while Europe can also bypass ” their own sanctions” to buy gas, both in the interest of “reality”.

The U.S. “symbolic” gas sales, Europe substantial losses

On March 31, U.S. President Joe Biden announced that the next six months will release 1 million barrels of oil per day from the U.S. Strategic Petroleum Reserve, a cumulative total of 180 million barrels, in response to the current supply shortage and high oil prices, and said this is the largest release of oil reserves in U.S. history.

Previously, the U.S. media had broken the news, resulting in international oil prices once plunged nearly 7%.

But at the subsequent OPEC+ meeting, OPEC members agreed to a production increase of only 432,000 barrels per day in May, which was only 32,000 barrels per day more than the steady increase of 400,000 barrels per day that had been in place for nine months.

Currently, the International Energy Agency (IEA), which represents the interests of the major Western energy consumers, and OPEC, which represents the major international oil producers, are increasingly going toe-to-toe.

In addition, since the war between Russia and Ukraine, the EU has been looking for new gas sellers to offset the risk of a Russian “gas cutoff. U.S. supplies of liquefied natural gas (LNG) by sea are now the main alternative source for Europe.

On March 25, U.S. President Joe Biden and European Commission President von der Leyen reached an agreement to ensure energy security. Under the agreement, the United States will supply an additional 15 billion cubic meters of natural gas to Europe this year to replace energy imports from Russia – which will increase U.S. natural gas exports to Europe by more than 60 percent.

In addition, Biden pledged to help Europe break away from its energy dependence on Russia by 2027.

But the pledge was criticized by the New York Times as merely “symbolic” because in the short term, “the United States simply does not have the capacity to export more natural gas, and Europe does not have the capacity to import it.”

In fact, Russia sends about 150 billion cubic meters of natural gas and 14 to 18 billion cubic meters of liquefied natural gas to Europe via pipeline each year. The U.S.-Russian gas supply is not a volume.

In addition, LNG shipments are far more expensive than Russian pipeline shipments due to the processes of liquefaction, loading and transportation, and re-vaporization, and are much less efficient and stable.

At the same time, LNG carriers require large specialized facilities to offload cargoes, and Europe currently has a very limited number of ports that can support LNG ship offloading. As the New York Times points out, a large import or export terminal can cost more than $1 billion to build, and it takes years to plan, obtain permits and complete construction.

Who should Europe and the U.S. turn to if they want to expand their LNG fleets?

On March 31, German Chancellor Schulz confessed that while the German government and businesses will strive to reduce their dependence on imports of energy materials such as oil and coal by the end of this year, specifically for natural gas, “we need a longer time”. Because whether it is transported by rail or road, or by ship or pipeline, Germany first has to consider the carrying capacity of natural gas transportation.

But in reality, there is no way to significantly increase the carrying capacity of natural gas transportation in Europe within three to five years. In particular, with the current capacity of LNG carriers in the U.S. and Europe, it is still far from being able to replace Russian gas.

Europe wants to expand its LNG fleet in the short term, and I’m afraid it will be difficult to “stand on its own two feet”.

Phoenix “eye of the storm” learned that LNG ships are internationally recognized as the most difficult to build high technology, high difficulty, high value-added “three high” giant ships.

At present, there are about 600 LNG vessels in the world with a total capacity of about 100 million cubic meters, and they are mainly used for LNG imports from Asia.

At the same time, the capacity of LNG vessels is mainly in the hands of China and South Korea, and since about 150 shipyards have been reserved in China and South Korea, including Qatar, the four main shipyards, including the three major South Korean shipbuilders and Hudong-Zhonghua, have been fully booked for delivery by 2025, and now the orders for new LNG carriers will have to be placed until at least 2026.

In addition, ordering new LNG vessels is not cheap, as LNG vessel orders have remained high for four consecutive years since 2018, with a total of 277 LNG vessel orders between 2018 and 2021, and LNG prices soaring by more than 300% in 2021, setting a record.

In terms of orders in recent years, the three major Korean shipping companies have undertaken 87% of global LNG ship orders, occupying an absolute advantage. In terms of the speed of capacity expansion, mainland China’s LNG fleet has increased from 4 vessels in 2015 to 59 vessels in 2022, with fleet value rising from US$800 million to US$9.2 billion, an astonishing increase of 1076.6%.

Europe will have to replace its “ship dependence” on China and South Korea to solve the LNG ship capacity problem and get rid of its energy dependence on Russia.

How does the settlement of gas in rubles affect the US dollar?

As Europe and the United States have long dominated the international financial market, international energy trade has actually been settled in U.S. dollars and euros as the main settlement currencies.

As of the third quarter of 2021, about 58% of Gazprom’s gas exports were denominated in euros, while only 39% were denominated in dollars.

The irreconcilable conflict between the U.S. and Russia is not only political, but in fact, the economic structure of the U.S. and Russia has many “mutually exclusive” aspects – both are major exporters of energy, military and food, and have very weak trade ties with each other, mostly as “competitors. They are both major exporters of energy, military and food, and have very weak trade ties with each other, mostly appearing as “competitors” in the international market.