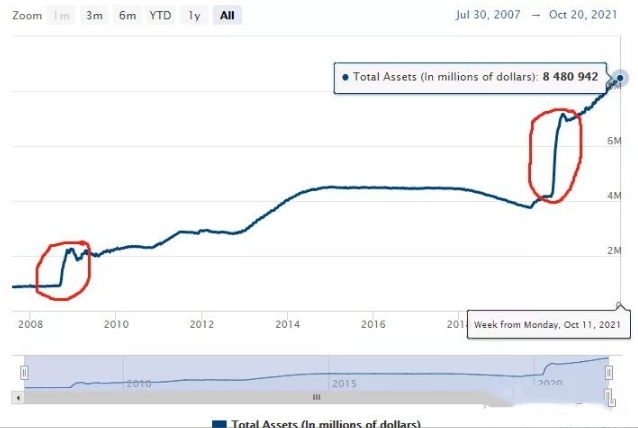

The Fed is finally tightening its policy, will rates be raised after taper? Will the bond market storm? What does the lesson of historical taper imply?What is taper?Taper refers to the Fed’s move to reduce the size of its bond purchases and shrink the Fed’s balance sheet.Taper is relative to QE, an unconventional monetary policy tool used by the Fed during the economic crisis, or quantitative easing, in which the central bank buys U.S. in the open market The central bank will purchase U.S. Treasury bonds of various maturities and real estate mortgage-backed bonds (MBS) in the open market, thus releasing liquidity into the market.

Taper is an important part of the Fed’s monetary policy implementation after the economic crisis. In quantitative easing (QE), the Fed’s balance sheet will continue to expand, while Taper aims to shrink the Fed’s balance sheet. It is important to note that tapering asset purchases does not represent a reduction in the balance sheet, much less a tightening of monetary policy, but simply a reduction in the easing in the later stages of easing, and a mere reduction in the rate of accumulated new assets in terms of the central bank’s balance sheet. The last Taper and QE review Taper is an important part of the Fed’s monetary policy that accompanies QE, then the Fed’s initial use of QE to ease the financial crisis was actually during the financial crisis in 08. At that time, the Fed made history by purchasing U.S. Treasuries and mortgage-backed bonds (MBS) to release funds into the market, aiming to save the financial system that was about to collapse. In the subsequent six years, a series of asset purchase programs were implemented, which is often heard of QE (Quantitative Easing). Simply put, the Federal Reserve purchased government-issued bonds, holding “IOUs” to lend money to various enterprises or institutions. When QE policy has completed the desired effect, tapering asset purchases (Tapering) is on the agenda.

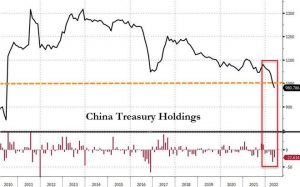

Tapering asset purchases as the literal meaning suggests, the Fed will gradually reduce the net purchase of assets, assets will continue to maintain the reinvestment of maturity. When asset tapering begins, it means that the amount of new base money will also be gradually reduced. The last time the Fed officially began Taper was in early 2014, but as early as May 22, 2013, Bernanke mentioned Taper at the semi-annual congressional hearing, which once caused a market “tapering panic” (taper tantrum), 10-year Treasury bonds suffered a sell-off, followed by In January 2014, the Federal Reserve officially began tapering its asset purchases, and in October of the same year, the Fed announced the end of its asset purchase program, and in December 2015, it announced a 25 basis point interest rate hike.

In this cycle of gradual cessation of lending, the dollar index was not immediately opened bullish trend. Because as early as before the formal tapering of bond purchases, the Fed members continued to release signals, driving the dollar first to open a wave of uptrend. The dollar started a long bull trend only after the assets were formally tapered for 4 months. Why start Taper now? From the perspective of risk prevention, the current U.S. economic recovery in general has reached an inflection point, high inflation is likely to shift to the medium to long term, due to the previous unprecedented large release has caused a financial bubble, if no more timely liquidity tightening, may cause the arrival of a financial crisis. Overall there are three important economic signals that dictate that the Fed has to start considering Taper: the current U.S. economy has generally recovered to pre-epidemic levels and U.S. economic data are slowly improving: data show that total U.S. real GDP in the second quarter has exceeded that before the epidemic and the economy has moved from a recovery to an expansionary period inflation is continuing to rise and is no longer expected to be temporarily high, the Close to the Fed’s target, Taper can leave room for subsequent monetary policy: Since the second quarter, the U.S. CPI inflation index exceeded expectations for several months in a row, as of September, CPI growth has risen to 5.4% year-on-year, the core CPI rose to 4.7% year-on-year. If the Fed does not withdraw from easing now, the follow-up may face greater risks. The current money market liquidity tends to be flooded, continue to release water is no longer necessary: the current market reality is not need so much liquidity, the institution eventually returned the money to the Fed through overnight reverse repo.

The relationship between Taper and interest rate hike Taper is a prelude to interest rate hike, but the length of this prelude is not the relationship between Taper and the immediate start of interest rate hike. Taper is not a direct signal to raise interest rates, and the conditions that need to be met are often more stringent: the Fed’s latest meeting left the policy rate unchanged at close to zero. The latest economic expectations released after the meeting showed that Fed officials expect the economy to grow more slowly this year than previously expected, but hinted that rate hikes could come sooner than expected. The dot plot shows that half of the officials expect to raise rates next year, and more than half expect to raise rates at least three times by the year after. Meanwhile, market expectations for next year’s rate hike are strong, with a 90% chance of a rate hike expected next September.

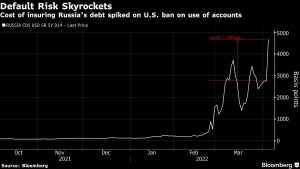

What is the impact of Taper on the market? The impact on the stock and bond market in the process of the Fed’s QE, the Fed’s bond purchases increased significantly, and U.S. bond yields trended upward. When the market expects the Fed to taper and the Fed discusses or implies that it will taper in the future, the U.S. bond yields will oscillate upward due to the upward drive in inflation expectations. Until after the Fed formally implements taper and QE ends completely, the upward movement of U.S. bond yields will begin to slow down significantly, and even begin to gradually fall back. After the current expansion, the Fed holds about 25% of the TIPS (inflation-protected bonds) (previously about 10%), and the rise in TIPS this year is far and even far ahead of junk bonds. From the experience of ’08, the yield on 10-year TIPS spiked 115 basis points in the 12 months between the Fed’s hint of a Taper at the end of ’12 and the actual implementation of the Taper in December 2013, and by September ’13, the yield spiked 178 basis points in less than 10 months (bond prices are inversely proportional to yields). So basically, the bond market moves not only heavy on expectations, but also on the Fed. When both are obvious, basically have also been in the TIPS price price-in. Look at the performance of several TIPS funds in ’08, basically in ’13 they all suffered badly, but in ’14 and ’15 they all stumbled back.

From the performance of the stock market after the last Taper, when the Fed hinted or announced QE tapering plan, due to the expectations of future liquidity tightening, U.S. stocks are prone to short-term pullbacks, but the magnitude of the pullback is small and lasts for a relatively short period of time, after which they soon regained their gains. If economic growth falls into a “low growth, high inflation” environment, the stock market will fall; if the economy remains somewhat resilient and inflation is relatively moderate, the stock market will shake or rise moderately in the process. In the process of QE tapering, the U.S. stock market basically showed a small increase in the state of oscillation. The impact on the dollar according to historical experience, from the performance of the dollar index in the process of QE withdrawal, the Fed hinted or formally discussed taper, the dollar index may have upward momentum in the short term, thus attracting global capital flows to the U.S. market, but did not change the trend of a weaker dollar. After the market thoroughly digest the bond purchase expectations, when the Fed really implement the reduction of asset purchases, there may be a trend of buying expectations to buy facts. But when the easing cycle is confirmed to enter the end, the bottom of the dollar (open bull market) will be a probable event.