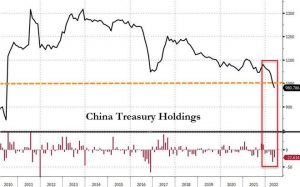

China reduced its holdings of U.S. Treasuries by $22.6 billion in May, the most among all countries, and sold a total of $100 billion for six consecutive months; Japan’s position dropped for three months in a row, hitting a new low of more than two years.

Official U.S. data show that in the Fed’s first interest rate hike of 50 basis points in twenty-two years and announced plans to reduce its position in U.S. debt from June in May this year, the two major overseas “debtors” of U.S. Treasuries China and Japan are continuing to sell U.S. debt, reflecting the continued interest rate hikes by the Fed to weaken the attractiveness of the situation.

According to the U.S. Department of the Treasury on Monday, July 18, the international capital flow report (TIC), by country and region, the

Japan’s May holdings of U.S. Treasuries fell by $5.7 billion from April to $1.2128 trillion, although still the highest position in U.S. debt, but has been reduced for three consecutive months, the total position continues to set a new low in early 2020. China’s position second only to Japan’s U.S. debt holdings in May fell by $22.6 billion from a year earlier to $980.8 billion, down for the sixth consecutive month, refreshing a new low since May 2010 set in April when it approached $1 trillion, the first time since May 2010 that the position was less than $1 trillion. The third position of the U.K. debt holdings in May increased by $ 213 billion to $ 634 billion, leaving the lowest position in six months set in April. Switzerland’s fourth largest position in May increased by $22.5 billion to $194.1 billion from a year earlier.

Wall Street News found that China sold a total of $100 billion in U.S. Treasuries in the six months through May, according to a projection from the TIC report. Among the major holdings of U.S. Treasuries, China sold the most in May, followed by Ireland in the seventh position and Canada in the 12th position, which reduced their holdings by $20.3 billion and $9.4 billion, respectively.

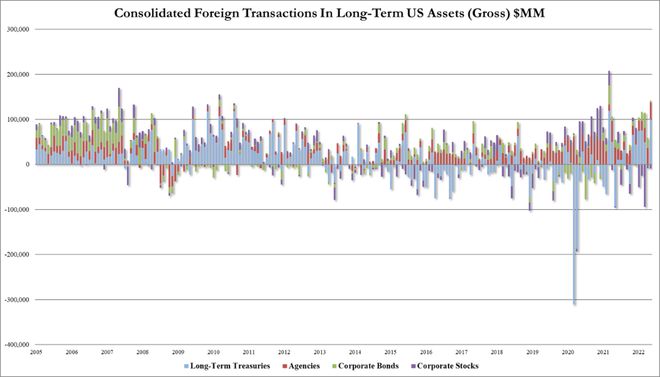

Overseas investors sold a total of $9.15 billion in U.S. corporate equities in May, expanding further from April’s $7.04 billion sell-off and the fifth consecutive month of selling, the longest consecutive selling month since late 2018. Overseas investors bought a net $99.864 billion in U.S. Treasuries in May, after selling $1.153 billion in April. Overseas bought $37.283 billion of agency debt in May, compared with $36.714 billion in April. Overseas bought $4.462 billion of U.S. corporate debt in May, well below the April buy size of $22.5 billion.

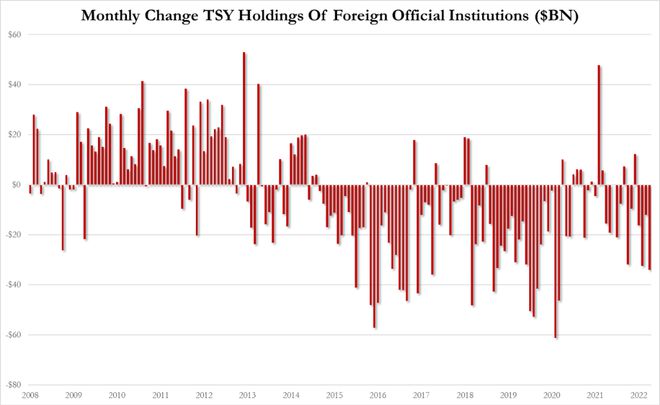

In the U.S. Treasury positions, central banks and sovereign wealth funds such as overseas official institutions sold $34.1 billion in May, brushing aside the largest monthly sale since the March 2020 U.S. outbreak of the new crown epidemic set in March this year.