U.S. Treasury Secretary Janet Yellen (first left) testifies before the House Banking, Housing and Metropolitan Events Committee on Capitol Hill in Washington, Sept. 28, 2008. Yellen urged The U.S. Congress to address the debt ceiling question. (Pool Photo/Xinhua)

After months of wrangling, both houses of The US Congress recently passed a bill to temporarily raise the federal government’s debt ceiling to save the government from a “catastrophic” debt default, US media reported. Experts point out that raising the US debt ceiling is just a cover, did not really eliminate the US debt burden. In the context of COVID-19, the US debt crisis may affect the recovery process of the US and the world economy.

deeper

Under a bill passed by Congress, the government’s debt ceiling was raised by about $480 billion to ensure that the Treasury Department can meet its spending obligations until December 3rd.

The debt ceiling is a very high borrowing limit set by Congress for the federal government. This “red line” means that the Treasury Department’s borrowing authority is exhausted and congress must raise or temporarily void the limit before continuing to issue debt. Statistics show that between 1960 and this year, The U.S. Congress raised the debt ceiling 78 times to stave off the government’s deficit spending dilemma.

“Debt is America’s chronic financial disease.” Wei Zongyou, a professor of American studies at Fudan University, pointed out in an interview with our reporter that there are multiple reasons why the US debt crisis is getting deeper and deeper in the context of COVID-19. First, the US economy has seen a precipitous decline due to the epidemic. Second, the previous administration’s sweeping tax cuts left a heavy burden on deficits and debt. Third, the FEDERAL government’s debt continued to climb as the US government implemented successive rounds of economic stimulus and epidemic rescue decisions, while defense estimates hit new highs.

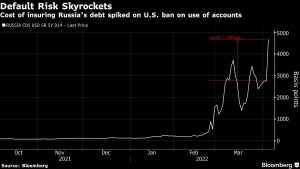

According to US media reports, the US federal government’s debt ceiling reached $28.4 trillion in August 2021. Treasury Secretary Janet Yellen has repeatedly warned Congress that if it does not move forward or freeze the debt ceiling, there is a very high probability that the federal government will find itself experiencing a debt default by October 18, with disastrous consequences for the U.S. economy.

U.S. legislative analysts say the federal government will once again face the twin dangers of a government shutdown and a debt default if Congress fails to move ahead with a new expiration date or a debt ceiling deal, despite temporary talks between the two parties on a debt ceiling reduction.

China contemporary foreign relations research institute researcher Chen Fengying pointed out to our reporter that the US debt question has a long history. Since the financial crisis of 2008, the US economy has become debt-oriented, and the COVID-19 pandemic has exacerbated its debt adversity. “This temporary increase in the US debt ceiling by the US Congress is only a deceleration hazard, and it does not really address the eternal layout of the US debt problem.”

Show ills

According to the New York Times, The top Republican in the U.S. House of Representatives, Mitch McConnell, sent a letter to President Joe Biden to make it clear that the Republicans will not support Democrats’ progress on the debt ceiling in the future, leaving Democrats to deal with the debt ceiling issue alone, using a method of reckoning. Property magazine said that the Democratic Party does not want to shoulder the responsibility and political pressure for the government s massive debt burden as it prepares to be elected to congress next year. Analysis of the two parties on the debt issue will be linked to wrestling.

The original intention of the US debt ceiling mechanism is to strengthen financial rules and master debt growth. But over time, the mechanism has increasingly become the subject of political battles. The New York Times article noted wistfully that “on public spending, as on other platforms such as public health, national bosses seem to have lost their talent for making the decisions needed to avert future crises.” The extraordinary new fight over the debt ceiling in Congress is just “a very new sign of Washington’s political dysfunction”, according to the Niskanen Center, a Washington think-tank.

“The U.S. debt is not just an economic question, but a political question.” Chen Fengying pointed out that under the two-party system in the United States, the tendency of politicization of debt question is obvious. Now America’s domestic politics are more fraught, partisan politics are fiercer and the debt question more polarised. At the same time, the United States carried out excessive quantitative easing policy, “releasing water” to the economy, further aggravating the burden of government debt.

“The recurring debt ceiling crises in the United States have exposed three chronic diseases in the United States.” Wei Zongyou pointed out that from the perspective of economic development, the United States blindly attached to a large range of debt, quantitative easing, excessive money printing and other mistakes, a large number of funds into the stock and bond environment trend, resulting in the stock market inflated. Economic development leaves the real economy, resulting in unreasonable economic layout, is tantamount to pulling luo to fill the house. From the point of view of the political system, the political struggle between the two parties in the United States has intensified, and the administrative talent and management talent of the government have been strained. Each blames the other for continuing to run deficits while the other is in power. It has threatened to raise the debt and raise the debt ceiling to force concessions and wage production is at risk. From the perspective of foreign policy, since the beginning of the 21st century, successive US governments have been Mired in the fight against terrorism and intensified foreign military intervention. As a result, military expenditure has been rising year by year, increasing financial burden. In addition, the United States unilaterally advocated commercial war, which hurt its own economy, led to the deterioration of its foreign trade status and the increase of its commercial deficit.

Multiple harmful

As COVID-19 continues to spread, the global economy is waking up in the dark. At this time, the US debt “bomb” lead has not been removed, encouraging foreign public opinion on the US debt back about sorrow.

“Probably encouraging a spike in interest rates, a sharp drop in stock prices, and other financial turmoil, the U.S. economy will fall back into recession.” So did Ms Yellen, who warned of the likely consequences. A very new research report from the Brookings Institution also noted that, even under the best circumstances, the debt ceiling impasse was only a few moments out of the way, and the U.S. economy might have suffered “a couple of outright preventable obstacles,” “especially out of the health of the economy.”

What is more noteworthy is that the U.S. debt ceiling debate will spread around the world through U.S. bonds, the dollar and financial trends, threatening the recovery of the global economy and consolidation of global financial trends. Cecilia Rouse, head of the White House Council on Economic Care, said the global economy had not yet fully recovered from the pandemic, and that a global financial crisis triggered by America’s debt crisis could be worse than the foreign crisis of 2008.

“The domestic and foreign damage from the U.S. debt crisis cannot be underestimated.” Wei zongyou pointed out that at the domestic level, the United States will face debt, government shutdown, increased partisanship, economic recovery will be affected, the growth of potential financial hazards, sovereign credit rating may be downgraded, the depreciation of the DOLLAR and other hazards. From the perspective of foreign countries, the US debt crisis exports global inflation, growth and turmoil of foreign financial environment trend harm, will affect the global economic recovery process.

“The global economy is waking out of three out of three: the economy is rising, currency is stretching, and debt. The last two are linked to the United States. If the U.S. debt crisis spreads and the debt crisis is prolonged, it will affect not only the U.S. economy but also the recovery of the global economy. Wei Zongyou further pointed out.

Amadou Si of the Brookings Institution, an American think-tank, suggests that a few economies will consider diversifying their reserves away from Us Treasuries.