This agreement will end decades of competition for tax havens for multinational companies, and it may also have a substantial impact on the cash flow of many multinational companies.

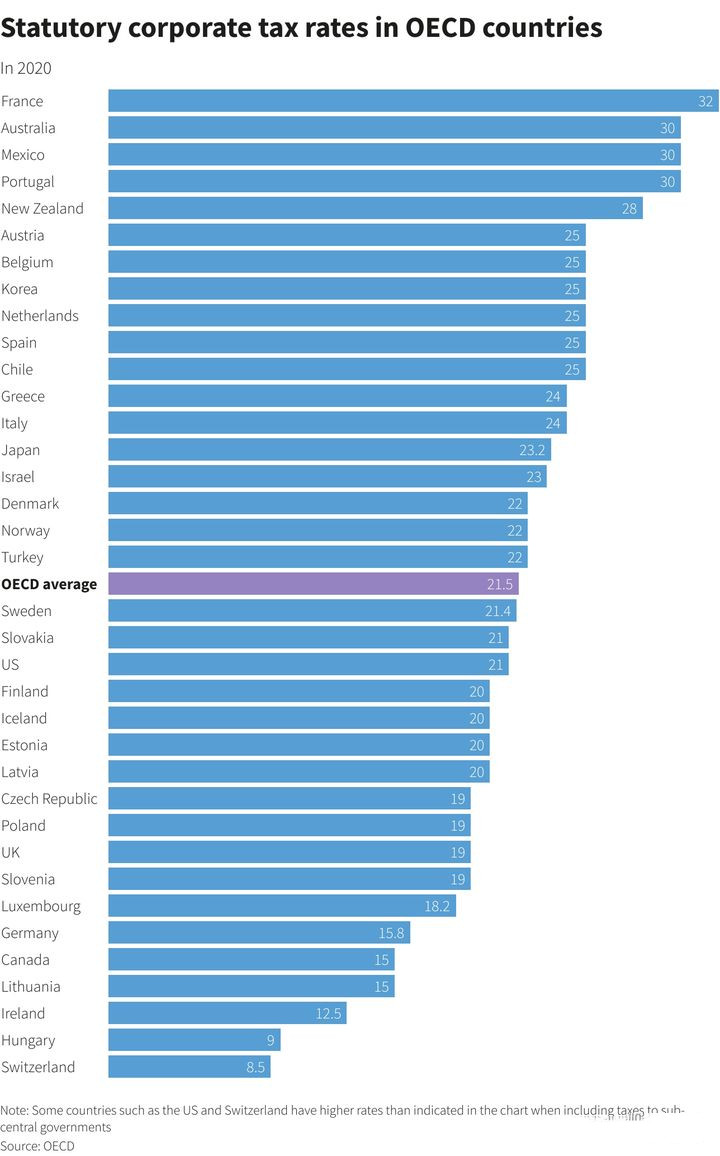

The content and background of the agreement On June 5, local time, the Group of Seven (G7) meeting in London reached a historic agreement, agreeing to set a minimum global corporate tax rate of at least 15%, but the new rules want to be applied globally. Need to get the agreement of the Group of 20 (G20) and 135 countries led by the Organization for Economic Cooperation and Development (OECD). According to the G7 official statement after the meeting, the relevant agreement mainly includes the re-division of the taxation rights of multinational corporations’ global profits among tax jurisdictions (mainly for large multinational technology companies) and the levy of 15% of the global minimum corporate tax on multinational corporations. , And if a company pays taxes in a place with a lower tax rate, it will need to pay the difference in taxes. In terms of taxation rights reform, the G7 finance ministers have reached an agreement that the largest and most profitable multinational companies will be required to pay taxes in the country where they operate, not just at their headquarters. Multinational companies enjoy an unfair tax system, which has been a long-standing problem. Because the tax system of each country is different, many multinational companies like to do business in low-tax countries or set up headquarters to avoid taxation. This is already an open secret. These countries, known as tax havens, also hope to attract more multinational companies through low tax rates. This has led to many multinational companies that have made a lot of money, but they don’t need to pay much tax. This agreement is expected to end decades of competition for tax havens for multinational companies, and it may also have a substantial impact on the cash flow of many multinational companies. Analysis of the impact of the agreement This agreement is bound to affect countries with low tax rates on a global scale. According to data from the Tax Foundation, countries with corporate tax rates below 15% in 2020 include Cyprus (12.5%), Ireland (12.5%), Kyrgyzstan (10%), Qatar (10%), Hungary (9%), and Jersey, the Cayman Islands, and the British Virgin Islands are safe havens with a zero tax rate.

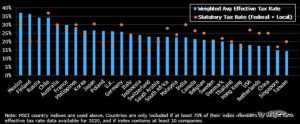

We can find that the tax rates of most countries in the world are higher than the minimum tax rate of 15%, and the agreement has not yet clearly stipulated which businesses will be included. It only involves the largest and most profitable multinational companies. Reuters reported that the world’s lowest tax rate will only be imposed on the world’s 100 largest and most income-generating companies.

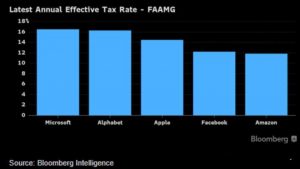

From this Bloomberg data graph, we find that there are three of the technology giants FAAMG: Apple, Facebook, and Amazon currently have effective tax rates below the lowest line of 15%. In the past 10 years, these three technology giants have paid corporate taxes as a percentage of their profits. Very low, such as Amazon only 9.8%, FB only 12%, which is lower than the 15% minimum tax rate proposed this time, and far lower than most other US listed companies. After the agreement, the tax rates faced by tech giants will be significantly increased, and it can be expected that they will face higher tax bills. In addition, these technology giants are extremely profitable companies, and the agreement stated that as long as the profit is higher than 10%, companies must pay a minimum 15% corporate tax. Unlike many early technology companies that are not yet profitable, technology giants have basically entered a mature stage, and their profit margins are generally higher than 20%, so it is difficult to avoid the tax policy in the agreement. Therefore, no matter how you look at it, the technology giants are the biggest losers in this tax agreement. Limitations of the agreement The agreement currently only covers a few members of the G7, and it is still facing certain challenges to expand to more countries. If the rules of the relevant agreements are to be applied globally, they need to be agreed by the Group of 20 (G20) and 135 countries led by the Organization for Economic Cooperation and Development (OECD). The G20 meeting is scheduled to be held in Venice next month. Whether the relevant G7 agreement can gain more support from countries will become the focus of the market. Under the principle of tax sovereignty independence, other countries are not obliged to accept the US plan. Only under the multilateral situation, that is, when many countries around the world, or even all countries agree, can it be possible to achieve the lowest corporate tax on a global scale. If the OECD reaches an agreement on this tax rate, it will also require relevant countries and regions to sign multilateral conventions, as well as countries themselves to make adjustments to the law. Even within the European Union, beneficiaries of tax systems like Ireland have clearly expressed their opposition. Therefore, it is still unclear what impact the final agreement after the game will have on technology companies. The agreement may alleviate the digital tax crisis faced by tech giants in Europe. Many European countries have imposed digital taxes on them one after another, which has caused these technology giants to be entangled in lawsuits in recent years, and the uncertainty of tax payment has also increased. In order to reach an agreement, the United States may then grant partial exemptions or offer compensation for this, and make concessions on issues of concern to the EU such as digital taxes. The European Union has made it clear that it will coordinate various taxation measures, including considering the removal of digital taxes while imposing a minimum tax rate. From this perspective, it is possible that technology giants may pay less or not pay digital taxes, which is also a potential benefit for them. For the technology giants, transferring taxation is only one of the means of tax avoidance, and they still have many other legal tax avoidance options. In the end, whether they will pay more taxes or how much they will pay, there are still many uncertainties in the long run. In the short term, the author believes that the agreement will not bring clear disadvantages to these multinational companies, especially the technology giants, and the market has not given much reaction. The stock prices of several technology giants did not generate too much due to the news that day. Large fluctuations, but also a certain degree of rise. The macro trend, whether it is this tax agreement, the previous anti-monopoly law, or the special taxes imposed by governments on technology companies, can reveal that governments have begun to reflect on their previous friendly policies to technology giants, and treat them on the general trend. The policy of the technology giants must be tightened. Although the short-term may not constitute a substantial negative for the technology giants, we need to always pay attention to the direction of the policy.