Inflation and sickle effect

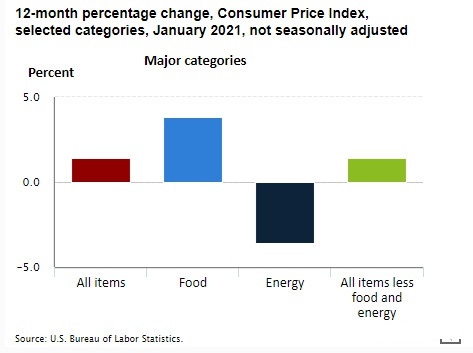

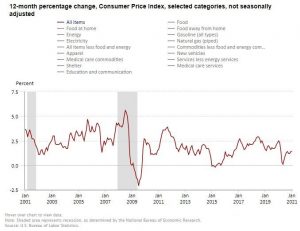

Recently, the topic of inflation has been discussed a lot. The most intuitive feeling of inflation is that prices are getting higher and higher, and money is becoming less and less valuable. Therefore, it will directly affect the lives of most ordinary people, but simply attribute inflation to rising prices, and the view that currency devaluation is still incomplete. Inflation itself can be turned into a sickle for cutting leeks, and knives are deadly. Then let’s talk about the working principle of this inflation sickle. How about it? In fact, inflation is divided into two parts, inflation and inflation expectations. The difference in time and price between these two parts forms a scissors gap. This scissors gap between inflation and expectations has harvested the vast leeks on the market. Let us first look at what inflation expectations are. The so-called inflation expectations refer to those that have not yet occurred, but the market believes that it is about to occur. Generally speaking, we will use some data to judge the inflation expectations. Let’s first look at the yield of 10-year Treasury Inflation-Protected Securities (TIPS) in the United States. Its yield is currently in the historically low range of -0.68%. This shows that the market’s expectations for inflation are relatively high. , The price of anti-inflation treasury bonds is rising. Let’s look at the breakeven inflation rate in the United States, which is also an important indicator of inflation expectations. According to data from the Federal Reserve, the five-year breakeven inflation rate has risen from 0.16% a year ago to nearly 2.5%, so statistics Sending a strong signal to the market constitutes a strong inflation expectation. Recently, so-called experts from both the U.S. and China have repeatedly emphasized that the issue of inflation has aroused people’s attention. Through data and propaganda, people’s expectations for inflation have been pushed up, and people’s inner anxiety has increased. The rise of the asset depreciation will force them to flee into the financial market, causing inflation on the asset side. This is the time when the sickle moves for the first round of harvesting. Expected inflation and actual inflation Let’s take a look at the actual price increase. According to official CPI statistics of various countries, the consumer price level in the United States has increased the fastest, and China’s CPI has rebounded the most, while Japan and the Eurozone are still in economic depression, but the increase in CPI between China and the United States is equivalent to the overall price. Is it going up? In fact, we can’t just look at the CPI numbers, but look at the reasons behind the changes in CPI. Eighty percent of changes in the U.S. CPI index are based on the three options of transportation, food, and housing, while the core CPI is basically synchronized with changes in energy prices such as oil. The recent sharp rise in oil prices indicates that the demand for transportation has become strong, and inflation expectations are also generated for this reason. In addition to the rise in energy prices, there is also the rise in commodity prices. Through relevant statistics, we can see that according to the calculation of the changes in the producer price index PPI, the price increase has been mainly concentrated in the upstream since the second half of last year. Extractive industries and raw materials industries, oil, natural gas, non-ferrous metals, minerals, etc. are all rising in price, while the midstream machinery and equipment and downstream manufacturing and retailing have basically remained unchanged, indicating that inflation has not yet passed to downstream manufacturing and retailing. If downstream demand is still sluggish, then companies will not be able to pass the costs on to consumers, and business failures will be even more serious.

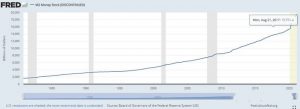

Simultaneous inflation and deflation. When we look back at the U.S. PPI index and CPI index, we will find that the current price increase is mainly on the production side and the raw material side, not the consumer side. The increase in the PPI index is obviously higher than the CPI. Yes, and this is the same situation in Mainland China. PPI growth exceeds CPI. Simply put, it is inflation on the production side and deflation on the consumption side. In the future, when this CPI catches up with PPI growth, inflation expectations will be transformed into real inflation. Therefore, the current situation is inflation at the production end, inflation at the asset end, and inflation at the raw material end, but the consumption end is deflation, so these three aspects On the one hand, the strange pattern of inflation and deflation will bring about a series of adverse economic effects. So the actual situation now is that the speed of economic recovery cannot keep up with the speed of inflation, and the speed of inflation cannot keep up with inflation expectations. This will bring about a series of problems. Inflation expectations are much higher than the speed of economic recovery in reality, which will cause trouble in two aspects: On the one hand, because central banks are eager to resume production, they have put too much money into the banking system, but the production side and the consumption side are now It is still sluggish, so a large amount of money has accumulated in the banking system, which continues to push up the prices of financial assets. Let’s look at the growth rate of broad money in the world’s major economies during the epidemic: all major economies are increasing their money supply. The growth rate of M2 in the United States has exceeded 20% last year to around 25%. We all know that the current economic relationship between China and the United States is still very large, and the inflation in the United States will be passed on to China. On the surface, China’s M2 does not have particularly high growth, but this situation does not mean that China’s economy is healthier and inflationary pressure is lower. In fact, China’s economy has very strong import characteristics, and the prices of energy and raw materials are very high. A large proportion is priced in U.S. dollars. Therefore, rising inflation expectations in the United States will further push up the cost of production and the cost of raw materials. The final result will push up the cost of production in China. Inflation will gradually be passed to the consumer end, which is the rise in retail commodity prices. At this time, in order to avoid overheating of the economy, the United States will gradually increase interest rates. This increase in interest rates will have a cascading effect, and China will have to raise interest rates. This increase in interest rates will be another major blow to China’s housing prices. It is precisely because China’s interest rates and inflation have strong external input characteristics, so China’s economy generally speaking, regardless of whether it is a boom or a depression , Which is also externally input.

On the one hand, let’s look at what aspects of inflation caused by the increase in interest rates from this external input will affect. Simply put, the increase in interest rates caused by inflation will directly raise the cost of borrowing, affecting housing prices and also affecting the operations of small and medium-sized enterprises. In addition, if the United States raises interest rates in the future, in order to avoid the return of funds to the United States, China must also raise interest rates to stabilize the renminbi exchange rate, and raise domestic interest rates to reduce inflation and stabilize prices. Once inflation forces interest rates to rise in the future, then China’s house prices are likely to fall, and the business environment for small and medium-sized enterprises will further deteriorate, which is certainly not conducive to China’s economy. So in order to prevent this from happening, there is a very high probability that outside of market regulation, China will strengthen government regulation. For example, in the real estate sector, it will strengthen price-limiting policies to prohibit excessively rapid housing prices and prohibit excessively rapid declines. . In terms of business operations, state-owned enterprises will further expand and devour the private economy. The planned economy is the least sensitive to interest rates. Therefore, strengthening the planned management of the economy will offset the negative effects of rising interest rates to the greatest extent. So on the whole, in the future, the United States will not only use market methods to adjust the US’s inflation input and interest rate input to China, but will use market adjustments and macroeconomic control methods to deal with it, and it is the government’s macroeconomic policy. The main focus is on regulation, which means that possible future adjustments in interest rates and inflation will speed up China’s entry into the characteristic market economy path characterized by national capitalism and strong planning. Let’s summarize the harvest in three aspects caused by inflation and interest rates. First, the fear of inflation has caused retail investors in the financial market to enter the market in panic and be harvested; second, the future rise in interest rates will burden companies and real estate debtors. Use interest rates. Come to harvest them; third, interest rates and inflation have caused the operating costs of private enterprises to rise, the crisis of private enterprises has intensified, and the state-owned economy has further expanded. That is, the state-owned sickle is further reaping private enterprises.

We often hear people say that the so-called hard day is coming, but in fact, before this hard day really comes, there is still a stable life for us. Although this day is not long, it is after all stable. When will this peaceful day end? Then one of our criteria for judging the arrival of this time is when the inflation changes from an expectation to real inflation, and when the real interest rate starts to rise, it is a symbolic signal that a day has changed from a stable day to a bitter day.